13 Mar Investing in the Dubai Free Zone

Dubai is one of the main investment destinations in Dubai, and is distinguished by providing a developed and encouraging investment environment for investors. In this comprehensive article, we will explore together investment opportunities in the Dubai Free Zone in cooperation with Itqan Company.

In cooperation with Itqan, we will address many important aspects related to investment in the Dubai Free Zone. We will provide an overview of the free zone, its features and its strategic geographical location. We will discuss the financial and legal facilities and advantages that the free zone provides to investors, such as tax cuts, customs exemptions, and business-friendly legislation.

We will also explore the role that Itqan plays in providing support and investment in the Dubai Free Zone . The company will offer its expertise and specialized knowledge in the field of legal and financial consulting to help facilitate the investment process and achieve financial success.

The article will also focus on the promising economic sectors in the free zone and the investment opportunities available in Dubai. We will highlight the commercial, industrial, logistical, technological, tourism and other sectors, and review emerging opportunities and interesting investment projects.

In short, this article will be a comprehensive reference for investors who want to explore and invest in the Dubai Free Zone in cooperation with Itqan Company. The article will provide valuable information and practical guidance for investors to make informed investment decisions and achieve success in their investment journey.

Investing in the Dubai Free Zone

Investing in the Dubai Free Zone

An investment in Dubai Free Zone can be an exciting option to consider for many companies and investors. Here are some reasons why your investment in Dubai Free Zone is favorable:

- Advanced business environment: Dubai is characterized by an advanced and innovative business environment, making it an attractive place for startups, medium and large companies.

- Advanced Infrastructure: Dubai provides advanced infrastructure that includes world-class facilities such as ports, airports and logistics networks.

- Access to Global Markets: Thanks to its strategic location, businesses in Dubai can easily access global markets, making it an ideal stop for international trade.

- Government Facilities: The UAE government provides a range of facilities and incentives for companies joining free zones, including tax exemptions and simple procedures for establishment and licensing.

- Economic Diversity: Dubai includes a variety of economic sectors such as trade, manufacturing, logistics, tourism and technology, providing multiple investment opportunities.

- Cultural and Societal Diversity: Dubai is home to a diverse and multicultural community, making it an ideal place to work and live for investors and employees from all over the world.

- Technology and Innovation: Dubai is considered one of the most technologically advanced cities in the region, providing a suitable environment for innovation and development in various fields.

The main economic sectors that exist in the free zone

Dubai’s free zones host a wide range of diverse economic sectors, and among the main sectors in which they are located are:

- Logistics and Distribution: Dubai is a transportation and distribution hub in the region, and the free zones include advanced logistics facilities that provide shipping, warehousing, and distribution services to resident companies.

- Manufacturing: Free zones in Dubai encourage the establishment and operation of manufacturing companies in various sectors such as food industries, electronic products, plastic products, and others.

- Technology and Innovation: Free zones attract technology, innovation, and information and communications technology companies, and provide a suitable environment for the growth of this industry.

- Financial and consulting services: The free zones in Dubai include many consulting and financial companies that provide specialized services in the fields of investment, finance, insurance, etc.

- Tourism and Hospitality: The tourism and hospitality sector is considered one of the most important economic sectors in Dubai, and free zones provide hotel facilities, entertainment facilities, and tourism services that support this sector.

- Commercial and professional services: Dubai’s free zones host many service, consulting and professional companies such as legal, marketing, training, real estate, and others.

Investing in Dubai

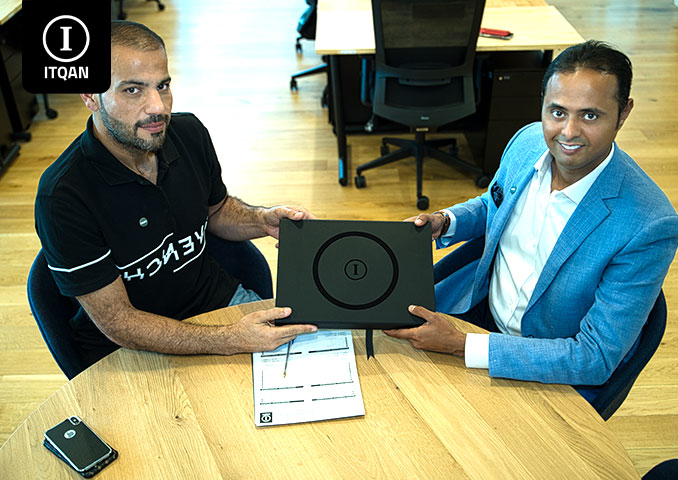

Investing in Dubai in cooperation with “Itqan” company can be a smart and successful move. Dubai is considered one of the world’s leading cities in the field of business and investment, as it enjoys an advanced infrastructure and a distinctive investment environment. In cooperation with “Itqan” Company, you can benefit from its extensive experience and knowledge in the Dubai market, as the company provides comprehensive services that include legal consultations, preparing documents, shareholder arrangements, and obtaining the necessary licenses and regulations. “Itqan” works to facilitate the investment process for you, and provides the necessary support to ensure the success of your business in Dubai.

In cooperation with “Itqan” Company, you can also benefit from its services in providing logistical and organizational support, and assistance in choosing the best type of company suitable for your needs and goals, whether it is an individual company, a partnership, or a joint stock company. In addition, “Itqan” company can provide you with assistance in submitting applications for residence visas for you and your family if needed, which makes the process of investing and living in Dubai easier and easier. In short, “Itqan” company can be a strong partner for you in your investment journey in Dubai, providing you with the support and assistance necessary to make your investment experience successful and fruitful.

Government facilities available to new companies in the Dubai Free Zone

The UAE government provides several facilities for new companies in the free zones in Dubai , and among these facilities are:

- Ease of incorporation procedures: Dubai free zones provide simple and easy incorporation procedures for new companies, which helps speed up the process of incorporation and starting a business.

- Foreign ownership: Dubai free zones allow foreign investors to fully own the companies they create, without the need for a local partner.

- No taxes: Dubai free zones are an environment free of income taxes for companies residing there, which helps increase profitability and stimulate investment.

- Access to the local and global market: Dubai free zones provide an opportunity for companies to access the local and global market easily, which helps expand business and increase business opportunities.

- Advanced Infrastructure: Dubai’s free zones provide advanced infrastructure including ports, airports, roads, and communications, which helps facilitate transportation and distribution operations and enhances efficiency in business.

- Government support and assistance: The UAE government provides government support and assistance to new companies in free zones, by providing advice, guidance, financial support and other facilities.

Work and residence permit for investors and their employees in the free zone

In Dubai’s free zones, government authorities facilitate the issuance of work and residence permits to investors and their employees. Here’s an overview of how:

- Work Permit for Investors: Investors can obtain work permits for themselves as directors or executives in their companies. Investors must also submit the required documents to the relevant authorities in the free zone, and pay the prescribed fees.

- Work permits for employees: In addition, investors can obtain work permits for their employees. The company must also provide the necessary documents for employees who wish to work in the UAE, and conduct the necessary medical examination.

- Residence Permit: After obtaining a work permit, investors and their employees can apply for residence permits in the UAE. They must also submit the required documents for immigration and residency and pay the related fees.

- Renewals: Individuals and companies must renew their work and residence permits regularly according to the specified dates.

Advantages of investing in the Dubai Free Zone

Necessary steps to export and import goods to and from the free zone

To export and import goods to and from the Dubai Free Zone, here are the basic steps to export and import goods to and from the Dubai Free Zone:

For export

- Registration in the commercial registry: The company must register itself in the emirate’s commercial registry and obtain the necessary permits for export.

- Obtaining an export license: An export license must be obtained from the competent authorities in Dubai, such as the Department of Economic Development or the relevant government agencies.

- Obtaining the necessary documents: The required documents include the export invoice, certificate of origin, shipping statement, and any other documents required for export depending on the type of goods.

- Customs procedures: The company must adhere to all customs procedures related to export, including submitting necessary documents and paying related duties and taxes.

For import

- Registration in the commercial registry: The company must be registered in the commercial registry in the emirate, and the company’s activity must be determined and the necessary licenses must be obtained.

- Obtaining an import license: An import license must be obtained from the competent authorities in Dubai, which may include the Department of Economic Development or other government agencies.

- Obtaining necessary documents: Necessary documents include purchase invoice, certificate of origin, shipping statement, and any other documents required for customs and customs clearance.

- Customs procedures: The company must adhere to all customs procedures related to importation, including submitting necessary documents and paying related duties and taxes.

Tips for investing in the Dubai Free Zone

Investing in Dubai can be a great opportunity for investors, but it takes some planning and research. Here are some important tips for investing in the Dubai Free Zone:

- Careful research: Before starting to invest, conduct careful research about the market and economic sectors available in the Dubai Free Zone. Learn about economic trends, emerging opportunities and potential challenges.

- Establish an investment strategy: Before making any decision, determine a clear investment strategy that includes your financial goals and the extent of risk that you are prepared to bear.

- Learn about government facilities: Take advantage of the government facilities available to companies in the Dubai Free Zone, such as tax exemptions and simple procedures for establishment and licensing.

- Connect with experts: Search for local advisors who specialize in investing in the Dubai Free Zone, and benefit from their experience and advice to obtain a profitable investment strategy.

- Diversification in investment: Try to diversify your investment portfolio to reduce risks, and explore investment opportunities in a variety of economic sectors.

- Connect with the business community: Participate in business and networking events in the Dubai Free Zone, and build relationships with key market players.

- Performance monitoring and investment evaluation: Regularly monitor the performance of your investments and evaluate the results based on pre-set goals, adjusting the strategy if necessary.

- Adherence to Legal and Regulatory Updates: Ensure you adhere to all legal and regulatory updates in the Dubai Free Zone, and update your strategy according to existing changes.

- Exploiting Technology: Look for opportunities to use technology and innovation in investment and business processes, which may increase business efficiency and improve financial results.

- Preparing for challenges: Anticipate potential challenges on the path to investment and try to plan for them and prepare to face them effectively.

At the conclusion of this comprehensive article about investing in the Dubai Free Zone in cooperation with Itqan Company, we reiterate the importance of Dubai as a leading destination for business and investment in the Middle East. The Dubai Free Zone is considered one of the most attractive economic environments in the world, as it enjoys legislation and procedures that encourage and facilitate business.

By cooperating with Itqan Company, investors can benefit from the expertise and specialized services provided by the company in the field of legal and financial consulting. Itqan helps investors understand local laws and regulations and provides the necessary support to facilitate the process of establishing and operating in the Dubai Free Zone.

The Dubai Free Zone provides a wide range of facilities and benefits to investors. These advantages include attractive tax deductions, customs exemptions, fast licensing, advanced infrastructure, and access to global markets. The Dubai Free Zone also provides a multicultural environment with diverse economic sectors, providing broad opportunities for success and growth.

Investors must conduct the necessary feasibility studies and consult Itqan Company and the competent authorities before making investment decisions. Local laws and regulations must be adhered to, and investors must have a comprehensive understanding of the risks and benefits of investing in the Dubai Free Zone.

The most important frequently asked questions about investing in the Dubai Free Zone

What are the competitive advantages of investing in the Dubai Free Zone?

The Dubai Free Zone provides advanced infrastructure, government facilities, tax exemptions, and easy access to regional and global markets.

What are the main economic sectors located in the free zone?

The sectors in the Dubai Free Zone are diverse and include trade, logistics, manufacturing, technology, tourism, financial services, and others.

What logistics and infrastructure are available in the free zone to support the business?

Dubai Free Zone provides a variety of logistics services such as ports, airports, warehouses, and advanced logistics centers.

What government facilities are available to new companies or investors in the free zone?

Government facilities include tax exemptions, simple procedures for establishment and licensing, and speedy completion of administrative transactions.

What restrictions or special conditions must be taken into account for companies wishing to invest in the free zone?

You must take into account the local laws and regulations of the sector to which the company belongs, and ensure compliance with all local conditions and restrictions.

What are the necessary steps to obtain a work and residence permit for investors and their employees in the free zone?

Permits and work permits are provided to investors and their employees when establishing a company, and procedures vary based on nationality and visa type.