09 Feb Establishing companies in free zones in Dubai

Some people wonder about establishing companies in free zones in Dubai, as Dubai is considered one of the most prominent global destinations that provides an ideal environment for establishing companies, especially in free zones. These areas have many advantages that make them an ideal destination for those wishing to start their own small or large projects. Establishing companies in free zones gives investors the opportunity to benefit from flexible investment policies and a favorable legislative environment, in addition to obtaining a set of economic and competitive advantages that enhance business success.

Dubai free zones provide exemption from fees and taxes for a limited period, which helps reduce additional costs and increase profits. These areas also provide advanced infrastructure and high-quality logistical services, which facilitates import and export operations and enhances the efficiency of commercial operations.

In addition, Dubai adopts flexible commercial laws and facilitates company establishment procedures, making the process of starting a business easier and smoother. Dubai is strategically located with easy access to global markets, giving companies the opportunity to expand and grow internationally.

This article will explore in depth the benefits of establishing companies in Dubai’s free zones, in addition to the steps needed to establish a company in these areas and the challenges that investors may face in the process.

Establishing companies in free zones in Dubai

Steps to establish companies in free zones in Dubai

There are some steps that must be followed when establishing companies in free zones , which are represented in the following points:

- Choosing the type of company: Start by determining the type of company you want to establish, such as a limited liability company (LLC), sole proprietorship, or joint stock company.

- Choosing a business activity: Determine the type of business activity that the company will undertake in the free zone.

- Choosing a free zone: Find a free zone that suits your company’s needs and provides the benefits you are looking for.

- Submitting an application: Submit an application to establish the company to the relevant government authority in the free zone you have chosen.

- Preparing the necessary documents: Prepare the documents required to establish the company, such as the social agreement and personal documents for shareholders.

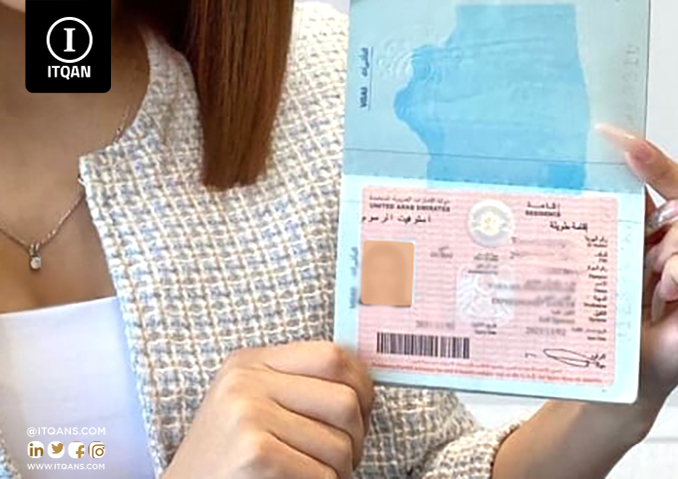

- Residence visa and work licenses: Arrange the necessary residence visas and licenses to work in Dubai if you plan to live and work there.

- Get an office: Rent an office in the free zone to use as your company headquarters.

- Registration with government agencies: Register your company with the relevant government agencies and obtain the necessary licenses.

- Opening a bank account: Open a bank account for your company in one of the approved banks in Dubai.

- Hiring labor: If you need labor, hire the employees needed to work for your company.

Establishing companies in Dubai’s free zones requires compliance with local laws and regulations, so it is important to obtain appropriate legal advice before starting this process.

Benefits of establishing companies in free zones

Establishing companies in free zones in Dubai offers many benefits and advantages that we have listed for you in several points, which are as follows:

- Exemption from fees and taxes: Free zones in Dubai provide an opportunity for companies to enjoy exemption from fees and taxes for a specified period, which helps save additional costs in the first stage.

- Ease of establishment and operation: Procedures for establishing companies in free zones are usually simple and quick, which facilitates a faster start-up process.

- Access to a global market : Dubai is located in a strategic location that facilitates access to global markets, which enhances opportunities for growth and international expansion for companies.

- Advanced infrastructure: Dubai has an advanced infrastructure that supports business activities, which contributes to improving work efficiency and service delivery.

- Flexible laws: Dubai adopts flexible laws that respond to the needs of companies, which helps facilitate business operations and achieve success.

- Access to skilled workers: Dubai provides an abundance of skilled workers of various nationalities, which helps in enhancing the competitive capabilities of companies.

- Logistics facilities: Dubai has advanced logistical facilities that facilitate import and export operations, which contributes to improving the efficiency of the supply chain.

These are some of the main benefits of establishing companies in free zones in Dubai, and there could be other benefits that depend on the type of company and its activity.

Steps to establish companies in free zones in Dubai

Types of companies that can be established in Dubai

Several types of companies can be established in Dubai ‘s free zones , and these types include:

- Limited Liability Company (LLC): LLC is one of the most common types of companies in Dubai, as the capital required to establish it is reasonable, and the company can be owned by one or more people.

- Joint stock company: This company is suitable for large projects that need large financing, as individuals and other companies can buy shares in the company.

- Sole proprietorship: This company is suitable for individuals who want to establish a company without partners, and the only person responsible for it is the owner.

- Sole Proprietorship Limited Liability Company: This company is considered an expansion of the sole proprietorship company, where responsibility is transferred from the owner to the company itself.

- Operating company with temporary capital: This company allows investors to establish a temporary company to implement a specific project without the need to establish a permanent company.

These are some of the main types of companies that can be established in free zones in Dubai, and local laws and requirements can vary slightly depending on the type of company and the free zone in which it is established.

Establishing companies in free zones in Dubai is subject to many local controls and laws, the most important of which are:

- Company Law: This law specifies the types of companies that can be established and the conditions for their establishment and management, in addition to the rights and duties of shareholders and managers.

- Labor Laws: Labor laws in Dubai regulate employment contracts, workers’ rights and duties, and specify minimum wages, working hours, and annual leave.

- Taxes and customs: Free zones in Dubai follow a low or exempt tax system, and provide customs facilities for import and export.

- Licenses and Permits: The necessary licenses and permits must be obtained from the relevant authorities before starting a business, such as a building permit, business licenses, and health permits.

- Intellectual Property Protection: Dubai provides legal protection for intellectual property rights, which helps protect innovations, trademarks and copyrights.

- Real estate registration laws: If you rent an office or space to your company, real estate registration laws regulate the relationship between the tenant and the lessor.

These are some of the main local laws and regulations related to establishing companies in free zones in Dubai, and investors should familiarize themselves with current legislation and communicate with the relevant authorities to ensure full compliance with local laws and regulations.

How can we support you in establishing companies in free zones in Dubai?

At the conclusion of this article, we find that establishing companies in free zones in Dubai is an important and smart investment step for many reasons. These areas provide an ideal business environment characterized by flexibility and effectiveness, making them a preferred destination for those wishing to start their own business projects.

Through available investment opportunities, government facilities, and advanced infrastructure, Dubai provides an ideal climate for startups, medium and large companies to develop their businesses and achieve success and growth. Local laws and controls also contribute to ensuring legal compliance and protecting investors’ rights, which enhances confidence in the investment environment in Dubai.

Given all these benefits, it can be said that establishing companies in Dubai’s free zones is a smart and feasible investment move for companies seeking to grow and prosper in a competitive global market.

The most important frequently asked questions about establishing companies in free zones

What are the different types of companies that can be established in Dubai free zones?

Several types of companies can be established, such as a limited liability company, a joint-stock company, an individual company, a company operating with temporary capital, and others.

What challenges may companies face in Dubai’s free zones?

Potential challenges may include complying with local laws and regulations, obtaining necessary financing, and attracting and retaining skilled human talent.

What are the free zones in Dubai?

Free zones in Dubai are special commercial zones that provide a favorable investment environment for companies, with tax exemptions and low or exempt customs duties.

What are the main benefits of establishing companies in free zones in Dubai?

Key benefits include low tax and customs exemptions, advanced infrastructure, easy and flexible incorporation procedures, and easy access to regional and global markets.