14 Mar Establishing a company in the Dubai Outsource City Free Zone

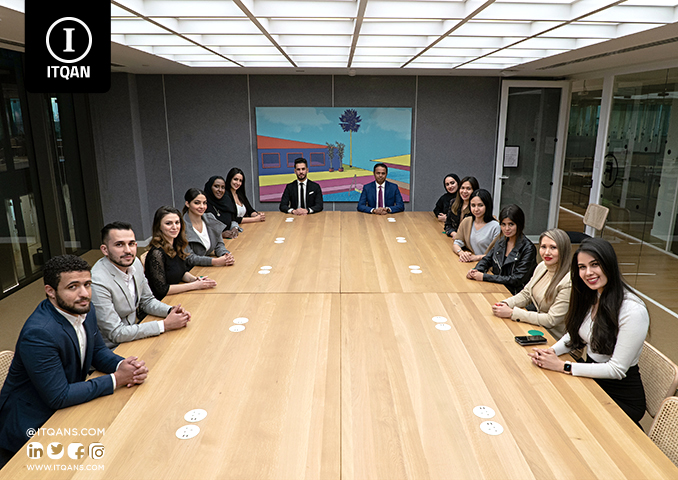

Over time, the Dubai Outsourcing District has become one of the most popular destinations for establishing companies in the Middle East, especially thanks to its thriving economic environment and the flexibility it provides to new companies. Among the companies specialized in facilitating establishment and investment operations in the region, Itqan stands out as a reliable and distinguished partner. Establishing a company in the Dubai Outsource City Free Zone is an exciting challenge for innovation and investment, as promising opportunities and an advanced business environment combine to provide an ideal platform for emerging and medium-sized companies to grow and prosper. In this article, we will explore the experience of starting a company in this dynamic region and the role of Itqan as a pivotal strategic partner in this process.

Establishing a company in the Dubai Outsource City Free Zone

Establishing a company in the Dubai Outsourcing City Free Zone requires adherence to the procedures and requirements specified by the competent authorities. Below is a set of basic costs and steps that may be included in the process of establishing a company in Dubai Outsourcing City:

- License Fees: A license fee must be paid to obtain a company license in Dubai Outsourcing City. These fees vary according to the type, activity and size of the company.

- Registration and visa fees: You need to pay the registration fees to the Dubai Department of Economic Development, as well as the visa fees for foreign managers and employees if they need to work for the company. These fees can vary according to the nationality of the employees and the visas required.

- Required capital: The required amount of capital depends on the type of company and the economic activity it carries out. The minimum capital is determined in accordance with applicable laws and legislation.

- Contracts and legal documents: It is necessary to prepare the contracts and legal agreements necessary to establish and operate the company. It is recommended to seek the assistance of competent legal counsel to ensure compliance with local laws and regulations.

- Office and Infrastructure Costs: You should take into account the costs of office rental, office supplies, and necessary equipment. It may also include infrastructure costs such as communications, internet, electricity and water.

- Additional Service Costs: If you require additional services such as logistics, warehousing, shipping, marketing and training, there may be additional fees involved in providing these services.

Please note that this information may be out of date and subject to change. To ensure obtaining the most accurate and up-to-date information, it is preferable to communicate directly with the relevant authorities and seek the assistance of specialist Itqan Company consultants to create a company establishment plan and estimate costs.

Establishing a company in the Dubai Outsource City Free Zone

Suitable investments for companies in the Dubai Free Zone

Suitable investments for companies in the Dubai Free Zone depend on several factors such as the type of company, investment objectives, and market needs. However, there are several investments that may be suitable for companies in this region:

- ICT: Since Dubai is a major technology hub, companies can benefit from investing in ICT areas, such as software development, graph analysis solutions, and cloud services.

- E-commerce: With the increasing demand for online shopping, companies can invest in e-commerce and create e-commerce platforms that meet the needs of local and international customers.

- Emerging Technologies: Dubai Free Zone encourages innovation and emerging technologies, making investing in startups and innovative companies in areas such as artificial intelligence, robotics, and biotechnologies an exciting opportunity.

- Tourism and Hospitality: Due to the increasing demand for tourism in Dubai, companies can invest in the hospitality sector and establish hotel projects, tourist resorts, and travel services.

- Financial Services: Companies can invest in financial services such as banking, insurance, wealth management, and advanced financial operations.

Benefits of establishing a company in the free zone in Dubai

Establishing a company in the Dubai Free Zone offers a range of benefits and advantages that make it an attractive option for investors. Here are some of the key benefits of establishing a company in the Dubai Free Zone:

- Tax exemptions: The Dubai Free Zone is considered a tax-free zone on the profits and income of companies registered in it, which means there are no taxes on profits or salaries.

- Full Ownership: Non-UAE investors are entitled to 100% ownership of the company without the need for a local partner.

- Customs Facilities: The Dubai Free Zone provides customs facilities such as importing and exporting goods without customs duties or restrictions on commercial operations.

- Advanced Infrastructure: Dubai Free Zone provides advanced infrastructure including high-speed communications, integrated logistics facilities, and banking and financial services.

- Access to global markets: Thanks to its strategic location, companies in the Dubai Free Zone can easily access the Middle East, North Africa and Asian markets.

- Administrative Facilities: The Dubai Free Zone offers administrative facilities such as simple procedures for establishing companies, and quick procedures for obtaining the necessary licenses and permits.

- Political and legal stability: Dubai has a stable political and legal environment, which ensures protection for companies and continuity of business operations without legal complications.

Suitable investments for companies in the Dubai Free Zone

Suitable investments for companies in a free zone in Dubai depend on several factors such as the type of company, market needs, and future strategies. However, there are several investments that are considered appropriate and encouraging in this region:

- Technology and Innovation: Companies can invest in areas of technology and innovation such as software development, smart solutions, artificial intelligence, and emerging technologies.

- Logistics and transportation: Due to Dubai’s strategic location, companies can invest in the logistics and transportation sector such as sea and air freight, and supply chain management.

- Tourism and Hospitality: Dubai is one of the most important tourism destinations in the world, so companies can invest in the hospitality sector such as hotels, tourist resorts, and travel-related services.

- E-commerce: With the increasing demand for online shopping, businesses can invest in e-commerce and digital marketing platforms.

- Financial Services: Companies can invest in financial services such as banks, insurance companies, and financial consulting.

- Energy and environment: Companies can invest in areas of renewable energy and environmental conservation, such as solar energy and green technologies.

- Education and Training: Companies can invest in the areas of vocational and technical education and training, as the demand for advanced education and modern skills increases.

These are just some of the possible investments, and the appropriate investment can be determined based on a market study and a comprehensive analysis of potential opportunities and challenges.

Establishing a company in the free zone in Dubai

Types of companies allowed in the Dubai Free Zone

In the Dubai Free Zone, several types of companies are allowed to be established to suit the needs of investors and existing projects. Here is a list of the types of companies typically allowed in the Dubai Free Zone:

| Type | the description |

|---|---|

| Free Zone Limited Liability Company (FZ-LLC) | A company consisting of one or more shareholders, with limited liability depending on the value of the shares owned by the shareholders. |

| Free Zone Enterprise (FZE) | A company consisting of only one shareholder and has limited liability. |

| Branch of a foreign company | A branch registered in the free zone of a parent company located outside the UAE. |

| A branch of a local company | A branch registered in the free zone of a parent company located within the UAE. |

Necessary requirements for establishing a company in the Dubai Free Zone

Submitting an application to establish a company in the Dubai Free Zone requires fulfilling a number of necessary requirements. Here is a list of the basic requirements you may need to apply to establish your company:

Company type: You must specify the type of company you wish to establish, such as a free zone limited liability company (FZ-LLC), a free zone enterprise (FZE), or a branch of a foreign or local company.

- Company name: A name for the company must be chosen that is consistent with local laws and regulations, and is unique and not similar to the names of other registered companies.

- Company activity: The main company activity that you will practice must be determined, and this activity must be compatible with local licenses and regulations.

- Shareholders and Directors: Complete information about the shareholders and directors of the company must be provided, including passport photographs and CVs.

- Business Plan: Requires the submission of a detailed business plan explaining the company’s objectives and its operational, marketing and financial plans.

- Capital: The company’s required capital must be determined and the required financial documents must be provided.

- Articles of Association and Articles of Association: The company’s Articles of Association and Articles of Association must be prepared and submitted with the application.

- Activity licenses: The necessary licenses and permits must be obtained to practice the company’s activities.

- Authorities’ approvals: Approvals must be obtained from the competent local authorities for the application and documents.

- Establishment fees: You must pay the fees required to submit the application and complete the procedures.

This is a general list of requirements, and actual requirements may vary based on the type of company, proposed activity, and local legal regulations. It is best to consult Itqan Company experts who specialize in establishing companies to ensure that all requirements are met correctly and effectively.

A company in the Dubai Outsourcing City free zone

Based on what was presented in the article about establishing a company in the Dubai Outsourcing City free zone, we find that this step requires careful study and specific legal procedures. Establishing a company in this region provides important opportunities for growth and expansion into regional and global markets. Itqan Company’s cooperation in this process is important, as it provides experience and specialization in the field of legal and regulatory consulting.

Using Itqan’s experience and guidance, new companies in the Dubai Outsourcing City Free Zone can avoid legal and administrative hurdles, and begin the incorporation process smoothly and effectively. With the launch of the new company, Dubai, as a major city for global business, demonstrates its attractiveness as a cutting-edge financial and commercial centre, enhancing the success and growth opportunities for new and existing companies in the region.

The successful conclusion of this journey lies in effective cooperation with companies such as Itqan, which provide support and assistance in every step of establishing the company. Therefore, we call on all ambitious companies to take advantage of this unique opportunity in the Dubai Outsourcing City Free Zone, and begin their success journey with confidence and consistency.

Itqan Company services for establishing companies in the Dubai Free Zone

Itqan Company provides a comprehensive range of services for establishing companies in the Dubai Free Zone. These services include:

- Business consulting: Providing comprehensive consultations to analyze needs and develop appropriate strategies for establishing a company in the free zone.

- Preparing documents: Assistance in preparing and submitting the documents required to register the company and obtain the necessary licenses from government agencies.

- Arranging meetings: Organizing meetings and appointments with government agencies and legal advisors to ensure the incorporation process runs smoothly.

- Searching for a site: Help in choosing the appropriate location in the free zone and obtaining the necessary permits to use industrial or administrative spaces.

- Tax Registration: Assistance with tax registration and electronic filing of taxes, social insurance, and other financial obligations.

- Legal assistance: Providing legal support and advice on all legal issues related to the establishment and operation of the company.

- Client Management: Providing client management services and ongoing support after the company is established to ensure smooth operation and sustainable growth.

- Training and development: Providing training programs and workshops to develop the skills of the company’s employees and enhance their efficiency and productivity.

- Investment guidance: Providing advice and guidance for appropriate investments and identifying investment opportunities in the free zone and outside it.

Frequently asked questions about establishing a company in the Dubai Outsource City Free Zone

What are the basic steps to establish a company in Dubai Outsource City Free Zone?

The steps include determining the type of company, submitting an application for incorporation with the required documents, paying fees, and obtaining the necessary approvals.

What are the documents required to establish a company in the Dubai Outsource City Free Zone?

Documents include passports for shareholders and directors, a detailed business plan, capital details, articles of association and articles of association, and activity licenses.

What are the benefits that can be obtained from establishing a company in the Dubai Outsource City Free Zone?

Benefits include tax exemptions, full foreign ownership, customs facilities, and a flexible legal environment.

How long does it take to establish a company in Dubai Outsource City Free Zone?

This depends on all documents and procedures being completed correctly, and can take approximately two to four weeks.