21 Jan Costs of setting up a company in Dubai

In the business world, Dubai attracts with its status as a global investment destination, providing a favorable and stimulating environment for companies from all sectors. One of the most important factors that investors consider when considering setting up a company in Dubai is costs. In this article, we will discuss the costs of setting up a company in Dubai and how Itqan can provide the necessary support for this process.

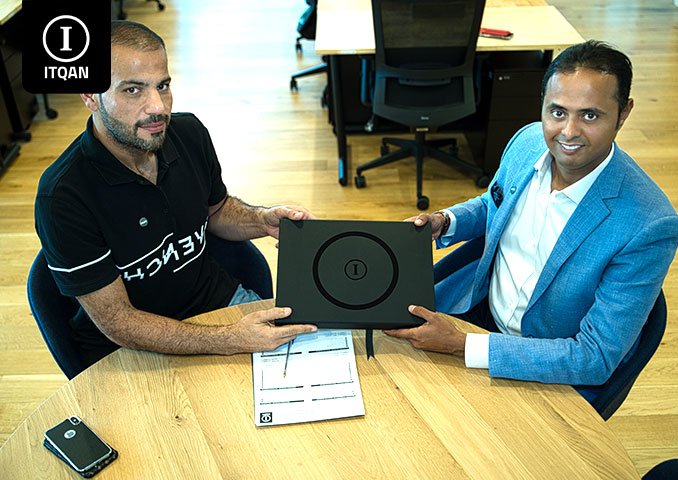

Dubai is considered one of the most attractive cities for business in the world, as it provides a legal environment and commercial legislation that contributes to facilitating company establishment procedures. In cooperation with Itqan Company, investors can obtain the necessary support in every step of establishing their company in Dubai.

In this article, we’ll take a comprehensive look at the costs associated with setting up a company in Dubai, including licensing costs, government fees, rental costs, and other financial aspects that need to be taken into consideration when starting the process.

Using the expertise and specialization that Itqan provides, we will provide practical advice and guidance on how to reduce costs and optimize your investment in creating a successful company in Dubai.

Costs of setting up a company in Dubai

The cost of setting up a company in Dubai varies based on several factors, including the type of company, the size of the business, and legal and administrative requirements. However, general estimates can be provided indicating the basic costs that can be expected. The costs of setting up a company in Dubai usually include:

- License fees: They vary according to the type of company and its activity, and may range from several thousand to several tens of thousands of UAE dirhams.

- Registration fees: Includes company registration fees with the Dubai Department of Commerce and Industry, and varies according to the type of company.

- Legal consultation fees: You may need legal advice to guide you through the process of setting up the company and ensuring compliance with local laws, and its cost varies based on the service provider and the required period.

- Administrative services fees: These include administrative fees for service offices that may need to be used to conduct administrative procedures and government transactions.

- Work fees: You must pay a fee to the Dubai Labor Authority to obtain a work permit for employees.

How to create a company in Dubai

Setting up a company in Dubai requires following several steps, here is an overview of the basic steps:

- Choosing a company type: The types of companies in Dubai vary from sole proprietorships to limited companies, public and private joint stock companies, and partnerships. Choose the type that matches your business needs and goals.

- Determine the name and ensure its availability: Choose a name for the company and ensure that it is available and that it complies with the rules of naming companies in Dubai.

- Identify shareholders and directors: Identify the shareholders and directors who will manage and own the company.

- Preparation of legal documents: Prepare the necessary documents such as the collective agreement (in the case of joint stock companies) and the articles of association, documented and approved.

- License Application: You may need to apply for a license from the relevant government authorities in Dubai, such as the Department of Economic Development or the Department of Commerce and Industry.

- Work Visas: Obtain the necessary work visas for the employees the company will employ.

- Opening a bank account: Opening a bank account in one of the approved banks in Dubai for the company’s financial transactions.

- Tax Registration: You may need to register with local tax authorities depending on your company’s tax needs.

- Office Secure: Secure a location for the company headquarters and ensure compliance with all local regulations.

- Visas and Accommodation: You may need to arrange visas and accommodation for directors and employees who work in the company.

Necessary documents to establish a company in Dubai

The documents required to establish a company in Dubai depend on the type of company and its activity, and can differ slightly between local companies and international companies. However, here is a general list of necessary documents you may need:

- License application form: This form contains company information such as its name, address, activity, and type.

- Personal documents for shareholders and directors: Passports and ID photos for shareholders and directors, and you may also need personal photographs and biographical certificates.

- Ownership documents: If the company is owned by a shareholder or group of shareholders, you may need documents proving this ownership.

- Incorporation documents: Documents proving the establishment of the company must be submitted, such as company contracts and internal agreements.

- Lease Documents: If the company will be renting a space to do business, you may need a copy of the lease or rental license.

- Financial Reports: You may need financial reports that demonstrate the company’s ability to bear the costs associated with the business operation.

- Work Licenses and Visas: You may need work licenses for your employees and residence visas if they are foreign citizens.

Establishing a company in Dubai

Business licenses available in Dubai

Dubai offers a variety of business licenses to meet the needs of different companies and investors. Here are some of the business licenses available in Dubai:

- Individual company commercial license: This license allows individuals to practice commercial activities under their own name, and the company can be owned and managed by a single business owner.

- Limited Liability Company Commercial License: This license allows joint stock companies to operate commercial activities legally, and provides protection to shareholders from personal financial liability.

- Business license for a public joint-stock company: This license requires the provision of specific capital and allows the company to raise money from the public through the sale of shares.

- The commercial license of a private joint-stock company: It is similar to the license of a public joint-stock company, but it is limited to a limited number of shareholders.

- Free business trading license: allows investors to conduct business without the need for a local partner, and allows them 100% foreign ownership.

- Industrial License: Allows companies to produce goods and products in a variety of industries such as manufacturing, assembly, and packaging.

- Professional Services License: Enables individuals who specialize in professional services such as medicine, accounting, and engineering to practice their work in Dubai .

Advantages of establishing a company in Dubai

- Dynamic Business Environment: Dubai is among the most dynamic cities in the world, providing diverse and ongoing opportunities for businesses to grow and expand.

- Strategic location: Dubai is located in the heart of the Middle East, making it a hub for trade and business in the region, and easy access to regional and global markets.

- Advanced infrastructure: Dubai is characterized by an advanced infrastructure that includes airports, ports, and modern transportation networks, which facilitates import, export, and distribution operations.

- Flexible legislation: Dubai adopts flexible commercial and tax legislation that contributes to attracting investors, with a stable and reliable legislative environment.

- Free Zones: Dubai offers free zones that provide advantages such as tax-free, proven foreign investment, and simple bureaucratic procedures.

- Availability of skilled workers: Dubai has a multinational international community that includes skilled and educated workers from various sectors.

- Diversity of economic sectors: Dubai’s economy has a great diversity of sectors, including real estate, tourism, trade, technology, creative industries, and financial services.

- Ease of administrative procedures: Dubai simplifies administrative procedures and reduces bureaucracy, making it easier to establish and operate companies.

At the conclusion of the article, we can conclude that establishing a company in Dubai requires good planning and thorough knowledge of the procedures and expected costs. Although there are financial costs and administrative procedures, the opportunities for success and growth in the Dubai market are rewarding. Thanks to the advanced infrastructure, dynamic business environment, and facilities provided by the Dubai government to businesses, investors can benefit greatly from investing in this wonderful city. If you intend to start your own business in Dubai, consultation with local experts and careful research can help you make the right decisions and achieve the desired success.

The most important frequently asked questions about setting up a company in Dubai

What are the basic steps to establish a company in Dubai?

This includes choosing the company type, determining the company name, submitting the required documents, obtaining the necessary licenses and permits, and registering the company.

What business licenses are available in Dubai?

Commercial licenses include general, professional, industrial, tourism, service, and others, and vary according to the company’s activity.

What are the expected costs of setting up a company in Dubai?

Costs are affected by the type of company and its requirements, and include licensing and registration fees, legal and administrative fees, rental and labor costs, among others.

What documents are required to establish a company in Dubai?

Documents vary depending on the type of company, but generally include personal documents for shareholders and directors, necessary contracts and financial documents.

How long does it take to obtain a business license in Dubai?

This varies depending on the type of company and licensing procedures, but generally it can take a few weeks to several months.